Here’s a list of books to help you understand your finances more clearly.

The Richest Man In Babylon

George S. Clason’s fake scriptural anecdotes about getting abundance have roused financial backers since the 1920s. Like the greater part of the individual accounting books that followed, The Richest Man In Babylon stresses saving overspending. Nonetheless, the book additionally demands that beneficent giving is similarly as significant if you don’t permit those two whom you provide to become reliant upon your gifts.

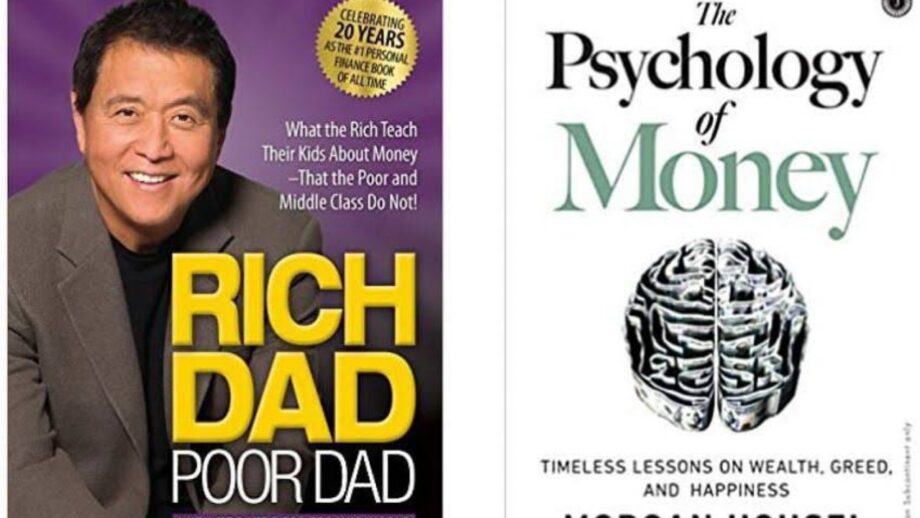

Rich Dad, Poor Dad

An eighth-grade dropout who spends short of what he acquires is more intelligent than a school educator who can’t earn enough to pay the bills, as per Robert Kiyosaki. Besides, while working for a consistent check can kick you off, the best speculation of your time and cash is to purchase property or a business. Or then again even better, do what Kiyosaki himself did and compose a top-of-the-line book.

The Millionaire Fast Lane

Buckling down, saving 10%, and resigning at 65 is a blockhead’s down because 1) monetary business sectors are excessively unpredictable and 2) you’ll “be in a wheelchair” when you have enough to resign, as indicated by creator MJ DeMarco. A superior system is to utilize the unpredictability of the monetary business sectors to get rich rapidly and appreciate it now.

Your Money or Your Life

As opposed to prevalent thinking, living all the more economically increments (rather than diminishes) your satisfaction. Creator Vicki Robin refers to numerous models, for example, the act of working at particular employment that acquires not exactly the sum you pay out for childcare and “efficient” excursions to McDonald’s.

Keep reading with IWMBuzz.com.